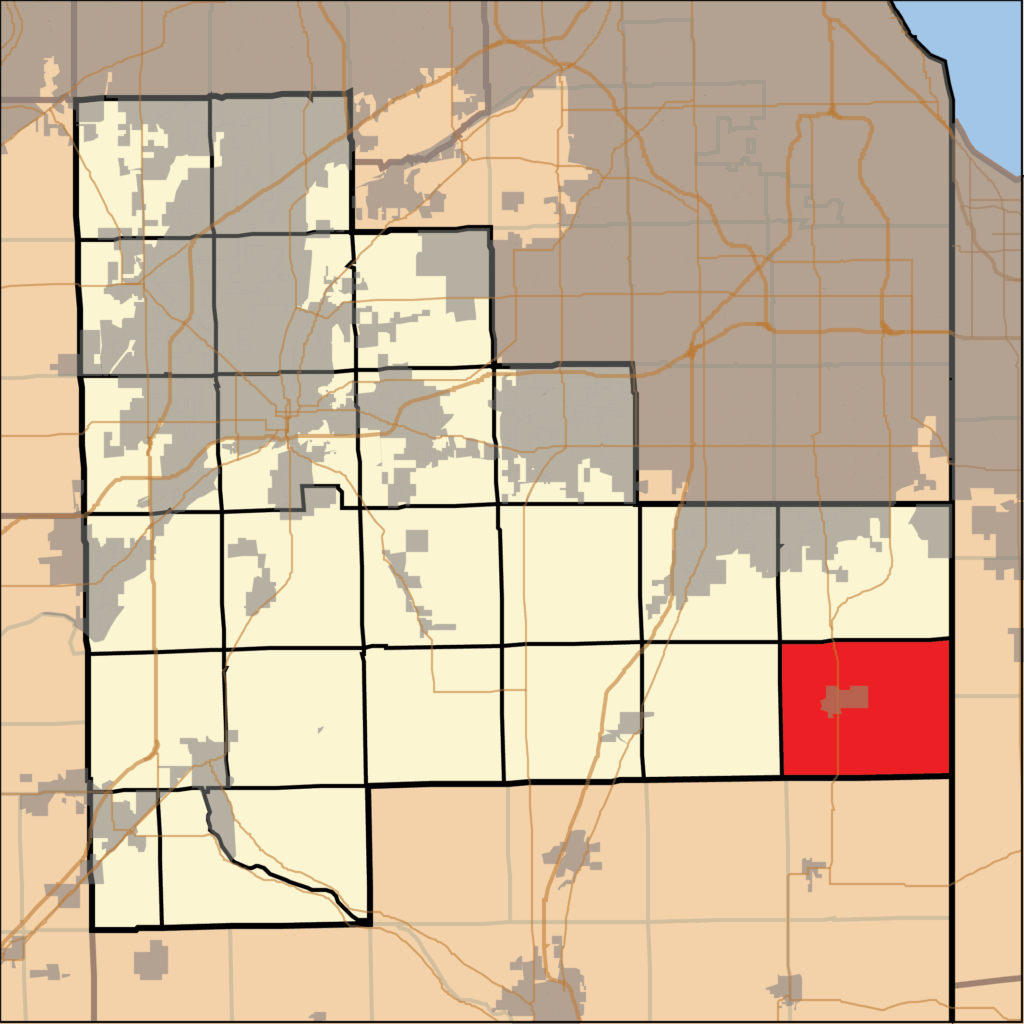

Beecher Faces $202,000 Revenue Loss, Considers Local 1% Grocery Tax

Article Summary: The Village of Beecher is contemplating the implementation of a local 1% grocery tax to prevent a significant budget shortfall of over $202,000 annually. This move comes in response to the State of Illinois’s decision to eliminate the statewide 1% tax on groceries, effective January 1, 2026, a revenue stream that currently flows directly to municipalities.

Local Grocery Tax Key Points:

-

The State of Illinois is repealing its 1% tax on groceries, which has historically been distributed to local municipalities, not kept by the state.

-

Beecher estimates it will lose over $202,000 in annual revenue if the tax is not replaced locally.

-

A new state law allows non-home rule municipalities like Beecher to enact their own 1% grocery tax by ordinance to avoid a lapse in funding.

-

If approved, the local tax would maintain the current cost of groceries for consumers, as they would continue to pay the same 1% they do now.

BEECHER – The Village of Beecher could face a revenue loss of more than $202,000 per year if it does not act to replace the state’s 1% grocery tax, which is set to be eliminated at the end of 2025.

During the village board’s June 23 meeting, Village President Marcy Meyer introduced the issue, explaining that a recent state budget decision will repeal the long-standing tax on groceries. While the repeal was promoted at the state level, the revenue from that tax has always been distributed directly to local towns and cities to fund essential services.

“The 1% grocery tax that everybody is paying now…never went to the state in the first place. This grocery sales tax goes to each of the municipalities to help them run,” Meyer explained. “It runs anywhere from small amounts to small towns up to millions of dollars for some of the big cities.”

For Beecher, the financial impact is substantial. “We’re estimating for Beecher that would come to about $202,300 some odd dollars per year that would get cut out of our budget if we do not reinstate the grocery sales tax,” Meyer said.

To prevent municipalities from losing this critical funding stream, the state legislation that eliminates the tax also grants both home-rule and non-home-rule communities the authority to implement their own local 1% grocery tax by passing a local ordinance. This allows towns like Beecher to bypass the need for a public referendum to maintain the tax.

If the board approves the measure, there would be no noticeable change for shoppers. They would continue to pay the same 1% tax they currently do, and the state would continue to collect and remit the funds back to the village. The local ordinance is a legal step required to ensure the revenue stream is not interrupted.

According to materials from the Illinois Municipal League, municipalities must submit a certified copy of an ordinance authorizing the local tax to the Illinois Department of Revenue by October 1, 2025, for the tax to take effect on January 1, 2026, and guarantee no lapse in revenue.

The board took no action at the meeting, as it was the first time the issue was formally discussed. Meyer stated the purpose was to inform the board and the public ahead of a future vote. “I am just putting it out there so that everybody is aware,” she said.

Latest News Stories

Sheriff’s Office Reports Crime Down 10%, Cites Body Cam Footage as Main Challenge of Safety Act

Will County Considers Moving Land Use Public Hearings Away from Full Board Meetings

Meeting Summary and Briefs: Washington Township Board of Trustees for August 4, 2025

Washington Township Board Backs Special Use Permit for Barn on Corning Road

Meeting Summary and Briefs: Beecher Public Library District Board for August 19, 2025

Will County to Pay Enbridge $82,000 to Relocate Pipeline Equipment for Exchange Street Improvements

Laraway Road Widening Project in New Lenox and Frankfort Gets Additional $468,000 for Redesign

“Federal Policy Uncertainty” Blamed for Delay of Peotone Solar Farm; County Grants Second Extension

Will County Grants Extensions to Five Solar Projects Sold to New Developers

Will County Board Approves Controversial Drug Recovery Retreat in Crete Township

Failed Repair Forces Replacement of 25-Year-Old Furnace at Washington Township Center

Beecher Library Board Approves Budgets for Current and Upcoming Fiscal Years