Chicago pension, debt services costs among highest in country

(The Center Square) – Chicago’s budget has grown by nearly 40% since 2019 with the biggest increased expenditure going toward pensions and debt already incurred.

Illinois Policy Institute policy analyst Ravi Mishra sees just one victim stemming from Chicago’s ballooning budget costs where most of the revenues continue to go be funneled toward pensions and debt already incurred.

“I believe if this issue is not resolved or it continues to grow it’s just going to add more taxes on top of what we already have, which is only going to drive out more businesses, something that the city has been struggling with over the past 5 or 6 years,” Mishra told The Center Square. “We’ve had 10 major corporations or corporate headquarters move out of the city. That’s tax money that the city can’t collect anymore and that’s jobs that can’t, that don’t go to Chicago residents.”

Since 2019, new data shows the city’s overall budget has grown by nearly 40% as government spending jumped by nearly $9 billion with at least 46% of that steered toward pensions and debt service.

As core services improvements and financial stability have also stagnated, Mishra said it’s not hard to picture what the city could soon look like.

“I think what it says is that the city is not on a good financial trajectory right now when so much of the net appropriations are going towards things that don’t improve the city, don’t improve its economy,” he said. “This could mean insolvency, which could mean millions of people losing their pension benefits. In the shorter run, it basically just means that more funds are going to be eaten up by pension and debt, which means less funds going towards things that people actually care about and need.”

At 40%, Chicago spends more of its budget on pensions and debt service than any other major city, including more than double that of New York and Los Angeles. More recently, lawmakers enacted legislation that could drop city police and municipal pension plans from current 25% funded levels to just 18%.

Mishra said every Chicago resident could be left paying the price.

Chicago Mayor Brandon Johnson proposed a budget that included multiple new tax hikes on businesses that could eat away at economic growth and prosperity, and much of those costs are going to be reflected on taxpayers’ bills, Mishra said.

“We already have some of the highest taxes in the entire nation, which makes it very hard for investment to come into the city,” he said.

Latest News Stories

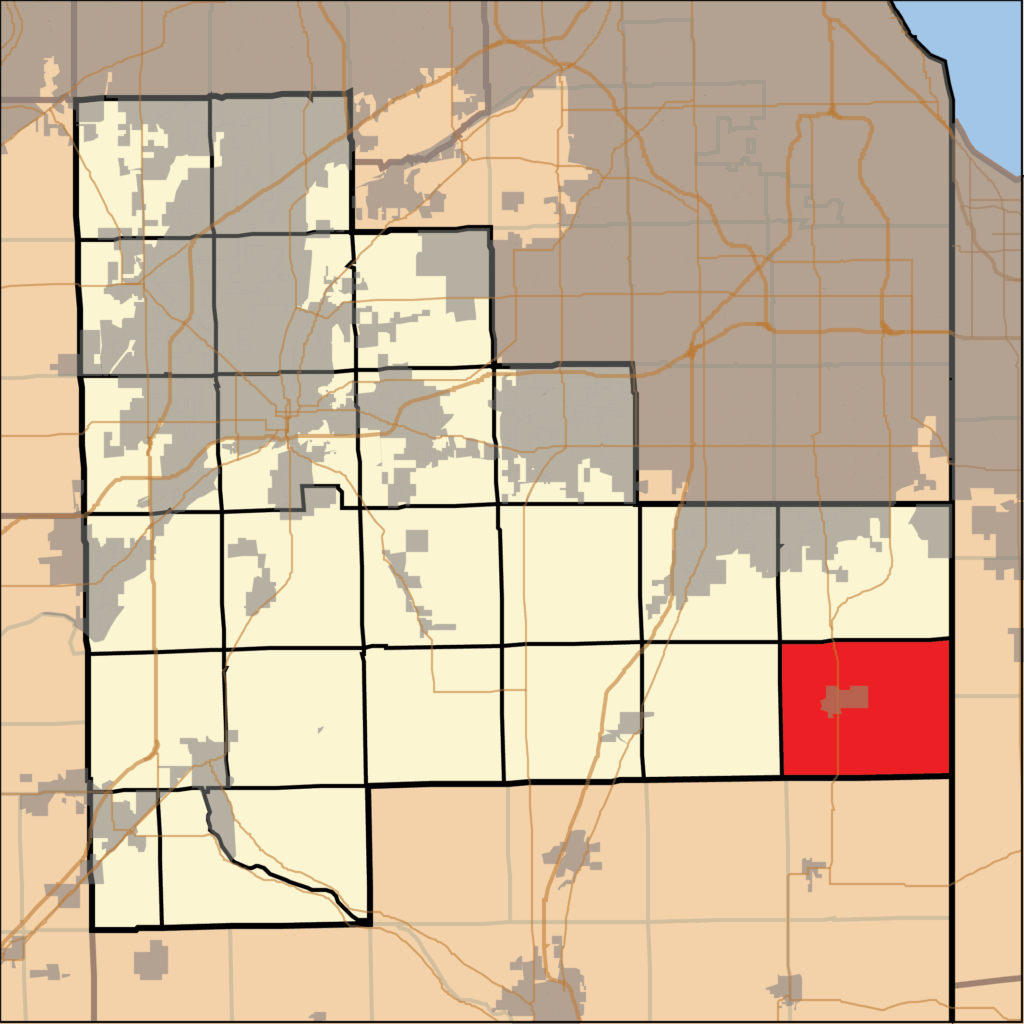

Beecher School Board Issues Suspension, Formal Notice to Remedy to Employee

Dr. Marie Hansel Appointed to Fill Vacancy on Beecher School Board

Beecher School Board Approves Amended Budget, New Staff Hires

Meeting Summary and Briefs: Beecher Board of Education for May 14, 2025

Washington Township Tables Decision on $11,000+ Security Upgrade, Seeks More Details

Washington Township Approves $2,500 in Sponsorships for Beecher EMS, July 4th Celebration

Washington Township to Continue Annual Senior Breakfast Amid Post-COVID Attendance Changes

Meeting Summary and Briefs: Washington Township Board of Trustees for May 5, 2025

County Approves $4.3 Million Purchase of Wetland Banking Credits for Highway Projects

Meeting Summary and Briefs: Beecher Fire Protection District Board of Trustees for March 20, 2025

Beecher Fire District to Hire New Lieutenant, Approves Updated Appointment Process

Labor Representative Addresses County Committee on Public Transportation Reform Efforts

Committee Advances $1.7 Million Upgrade Plan for River Valley Juvenile Detention Center