County Sales Tax Revenues Strong, Cannabis Funds Dispersed to Community Programs

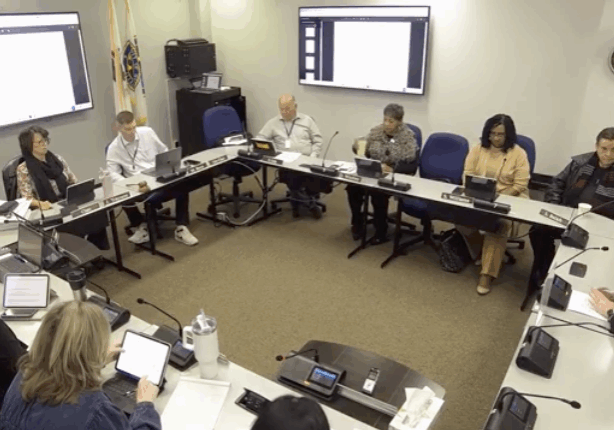

Will County Finance Committee Meeting | November 2025

Article Summary: Will County’s key sales tax revenues are on track to meet or exceed budget projections for fiscal year 2025, though Local Use Tax collections are lagging due to a change in state allocations. Meanwhile, the county has distributed over $4.1 million in cannabis tax revenue to social programs since 2020.

Will County Revenue Key Points:

-

Through September 30, State Sales Tax collections reached nearly 90% of the annual budget, while RTA Sales Tax is at 86%.

-

Local Use Tax collections are at 30% of budget, a shortfall attributed to changes in how the state allocates funds.

-

Since 2020, the county has distributed $4.15 million from cannabis taxes to programs supporting housing, workforce reentry, and public health.

Will County’s primary sales tax revenues are performing strongly through the first three quarters of the fiscal year, according to a report presented to the Finance Committee on Tuesday, November 4, 2025.

Finance Director Karen Hennessy’s update showed that as of September 30, collections for most major revenue streams were on pace. State Sales Tax revenue stood at $5.9 million, or 89.9% of the fiscal year 2025 budget. RTA Sales Tax collections were at $28.2 million, representing 85.6% of the budget.

However, the Local Use Tax showed a significant shortfall, with collections of $1.18 million reaching only 29.7% of the $4 million budget. Hennessy explained this was not due to a drop in economic activity, but rather a shift by the state. “When we set the budget and estimate, the state changes things afterward,” she said. “We’re getting a little bit bigger piece of regular sales tax, so we’re getting less of the local use tax.”

The report also detailed collections and distributions from cannabis sales taxes. Since the tax was implemented, Will County has collected over $6.9 million. Of that, $4.15 million has been distributed to various county programs, including housing stabilization, the Child Advocacy Center, Problem Solving Courts, workforce reentry services, and grants for childcare and small businesses.

Latest News Stories

Stock market weathers Fed governor’s attempted firing well

WATCH: Police officer, legislator: Seize opportunity to reform Illinois’ cashless bail

Trump proposes returning death penalty to D.C.

WATCH: IL Hospital Association: $50B rural hospital fund ‘woefully inadequate’

Arizona, Nevada pay less at the pump than California

EEOC celebrates 200 days of protecting religious freedom under Trump

U.S. mining operations discarding rare minerals at center of trade talks

Duffy warns states to enforce English proficiency requirements for truckers

Illinois quick hits: Chicago businesses at 10-year low; school admin survey closes soon

Pritzker unveils Illinois LGBTQ hotline amid debate over transgender athletes

WATCH: Trump ends funding for cashless bail policies, hedges on Guard deployment to Chicago

Hochul pushes back on Trump’s cashless bail funding threat